The Fund sets an investment strategy to achieve a target level of return and sufficient cashflow over the longer-term in order to meet its liabilities.

The Fund’s Investment Strategy Statement sets out the approach to investment strategy and the target asset allocation. This document along with the investment strategy is reviewed annually. The Fund’s Investment Strategy Statement can be found in the Downloads section.

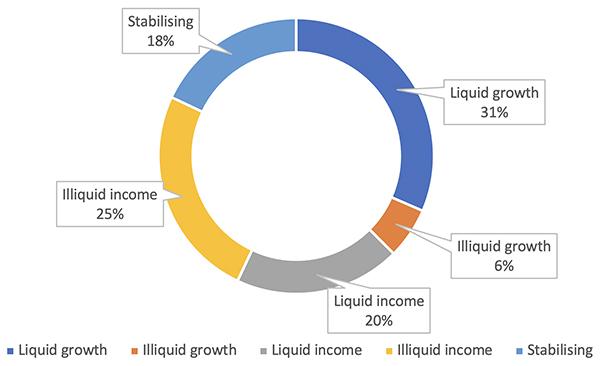

The Fund invests in three broad categories of assets:

- Growth assets – to generate a return in excess of the risk-free rate over the long-term.

- Income assets – to generate an income return over the long-term that meets future liabilities and reduces funding volatility.

- Stabilising assets – to reduce volatility of the funding level to changes in interest rates and inflation expectations as well as providing income to meet cashflow payments as they fall due.

Target allocation