The McCloud judgement and your LGPS pension

This summarises the McCloud judgment and changes the Government is making to the Local Government Pension Scheme (LGPS) in England and Wales.

The changes may affect you if:

- you were paying into the LGPS or another public service pension scheme before 1 April 2012

- you were also paying into the LGPS between 1 April 2014 and 31 March 2022

- you have been a member of a public service pension scheme without a continuous break of more than 5 years

What is the McCloud judgement?

When the Government reformed public service pension schemes in 2014 and 2015, transitional protections were introduced for older members. In December 2018, the Court of Appeal ruled that younger members of the judicial and firefighters’ pension schemes had been unlawfully discriminated against because the protections did not apply to them.

This ruling is called the McCloud judgment, after a member of the Judicial Pension Scheme involved in the case. Because of the ruling, there will be changes to all public service pension schemes that provided transitional protection, including the LGPS.

The changes are called the McCloud remedy and are intended to remove the age discrimination found in the McCloud court case.

How is the LGPS changing?

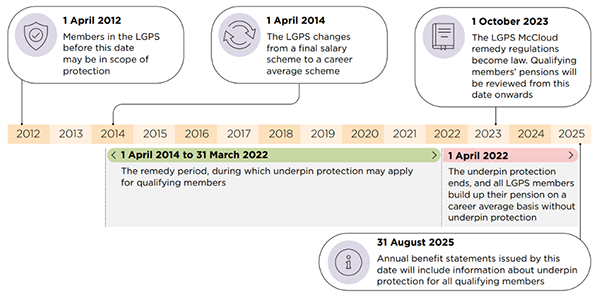

In 2014, the LGPS changed from a final salary scheme (a pension based on your pay when you leave) to a career average scheme (a pension which builds up based on what you earn each year).

Older members who were closer to retirement were protected from the changes. This means when a protected member takes their pension, the benefits payable under the career average scheme are compared with the benefits that would have been built up, had the final salary scheme continued and they receive the higher amount. This protection is called the underpin.

To remove the McCloud age discrimination, qualifying younger members will now receive the underpin protection too. This change will come into force on 1 October 2023. Underpin protection only applies to pension built up in the remedy period, between 1 April 2014 and 31 March 2022.

The underpin will have stopped earlier if you left the scheme or reached your final salary

Am I affected?

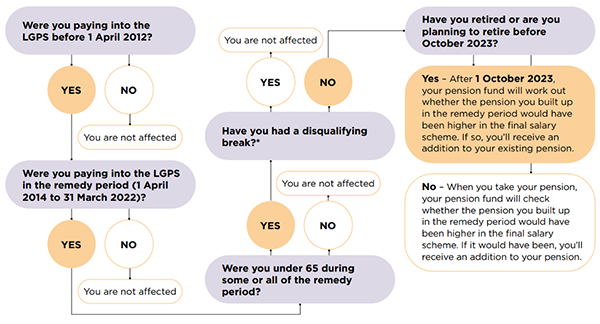

You may qualify for underpin protection if you were a member of the LGPS before 1 April 2012 and at any time between 1 April 2014 and 31 March 2022, as long as you did not have a disqualifying break. A disqualifying break is a continuous period of more than five years when you were not a member of a public service pension scheme.

If you have had more than one period of LGPS membership, the Government is considering if those periods have to be joined up or ‘aggregated’ to determine whether you qualify for underpin protection. The Government will seek views on this in 2023, ahead of announcing a final decision.

You may also qualify for protection if you were a member of another public service pension scheme before 1 April 2012 and you transferred that membership to the LGPS. The Government is considering whether you should also qualify for underpin protection if you have not transferred that membership to the LGPS. The Government will seek views on this in 2023, ahead of announcing a final decision. You can use the tool below to see if the changes could affect you.

What do I need to do?

If you qualify for protection, it will apply automatically - you do not need to make a claim or contact us. We will contact you when the government puts the regulations in place.

For more information see the frequently asked questions on the national LGPS website.

Will my pension increase?

This depends on the pension that you have built up when you take your pension. You don’t need to do anything – the Fund will work out whether you are due any additional pension and contact you. Many members won’t see an increase because the pension they build up in the career average scheme will be higher than what they would have built up in the final salary scheme.

Do the changes affect me if I qualified for original underpin protection?

If you already qualified for protection under the original rules for protection, your pension fund will work out if you are due an addition to your existing pension. They will do this as soon as they can after 1 October 2023.

How can I find out more?

This factsheet doesn’t cover all circumstances or provide a detailed explanation of the McCloud remedy, which will be set out in legislation. For more information on how the McCloud remedy may affect you, contact your pension fund. For LGPS fund contact details please visit LGPS - Contact your fund.

Key dates